https://cleartax.in/s/gst-hsn-lookup

GST Registration

GST Registration

Read here to know about the GST registration applicability on your business and the process thereof.

Updated on

Any business in India that supplies goods or services with the turnover exceeding Rs. 20 lakh (Rs. 10 lakh for North Eastern and hill states) has to get registered under GST.

In this article, we cover the following topics:

- What is GST Registration & why should you register?

- Who should get registered under GST?

- Businesses that need to register under GST irrespective of their turnover

- What are the documents/details required to register with GST?

- What is the GST registration process?

- GST Registration Fees

- What is the penalty for not registering under GST?

- What is GSTIN?

- When should a business apply for multiple GST registrations?

- What is Composition scheme and when should a business opt for it?

- Benefits of registering under GST

To know the step-by-step guide to register on GST Portal.

1. What is GST Registration & why is it necessary?

Every business carrying out a taxable supply of goods or services and whose turnover exceeds the threshold limit of Rs. 20 lakhs (Rs 10 lakhs for North Eastern and hill states) is required to register as a normal taxable person. This process of registration is called GST registration.

For certain businesses, registration under GST is mandatory. If the organization carries on business without registering under GST, it will be an offense under GST and heavy penalties will apply.

2. Who should get registered under GST?

Any business whose turnover exceeds the threshold limit of Rs. 20 lakhs (Rs 10 lakhs for North Eastern and hill states) will have to register under GST. Businesses registered under any of the pre-GST laws: VAT, Excise/Service Tax have to register under GST by default.

Apart from the normal taxpayer (as defined above), there are few special cases (as explained in section 3) that have to register for GST irrespective of their turnover.

3. Businesses that need to register under GST irrespective of their turnover

- Every person who is registered under the Pre-GST law (i.e., Excise, VAT, Service Tax etc.) needs to register under GST.

- When a business which is registered has been transferred to someone, the transferee shall take registration with effect from the date of transfer.

- Anyone who drives inter-state supply of goods**

- Casual taxable person

- Non-Resident taxable person

- Agents of a supplier

- Those paying tax under the reverse charge mechanism

- Input service distributor

- E-commerce operator or aggregator**

- Person who supplies via e-commerce aggregator

- Person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person

**Latest Update:

As per 23rd GST Council Meet on 10th November 2017

E-commerce sellers/aggregators need not register if total sales are less than Rs. 20 lakh. Notification No. 65/2017 – Central Tax dated 15.11.2017

As per 22nd GST Council meeting of 6th October 2017

Service providers providing inter-state services are exempted from registration if their annual turnover is below 20lakhs (10 lakhs for Special states. 20 lakhs for J&K)

Notification No. 7/2017 – Integrated Tax dated 14th September 2017

Job workers making inter-state supply of services to a registered person are exempted from registration if their turnover is below 20lakhs (10 lakhs for Special states)

4. What are the documents/details required to register with GST?

PAN is mandatory to apply for GST registration (except in case of non-resident).

The document/details required to register for GST are:

5. What is the GST registration process?

Any business can get registered under GST by applying via the GST Online Portal or at GST Seva Kendra set up by the Government of India.

The Goods And Services Tax (GST) Registration services at ClearTax helps you to get your business GST registered and obtain your GSTIN.

Here is the step by step info-graphic on the registration process :

6. GST Registration Fees

Businesses can register for GST and obtain GSTIN free of cost.

However, GST Registration is a tedious 11 step process which involves submission of many business details and scanned documents.

You can opt for ClearTax Goods And Services Tax (GST) Registration services where a GST Expert will assist you to end to end with GST Registration.

7. What is the penalty for not registering under GST?

An offender not paying tax or making short payments (genuine errors) has to pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10,000.

The penalty will at 100% of the tax amount due when the offender has deliberately evaded paying taxes

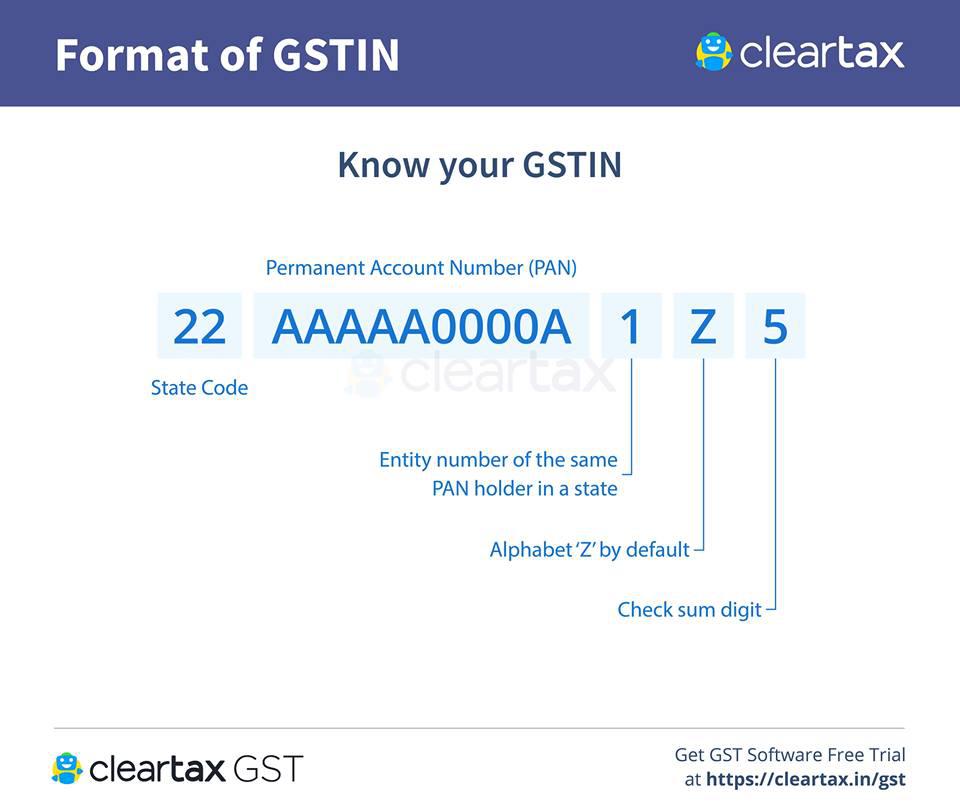

8. What is GSTIN?

All businesses that successfully register under GST are assigned unique Goods and Services Tax Identification Number also know as GSTIN.

7. What is the penalty for not registering under GST?

An offender not paying tax or making short payments (genuine errors) has to pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10,000.

The penalty will at 100% of the tax amount due when the offender has deliberately evaded paying taxes

8. What is GSTIN?

All businesses that successfully register under GST are assigned unique Goods and Services Tax Identification Number also know as GSTIN.

9. When should a business apply for multiple GST registrations?

If a business operates from more than one state, then a separate GST registration is required for each state. For instance, If a sweet vendor sells in Karnataka and Tamil Nadu, he has to apply for separate GST registration in Karnataka and TN respectively.

A business with multiple business verticals in a state may obtain a separate registration for each business vertical.

10. What is Composition scheme and when should a business opt for it?

Small businesses having the annual turnover less than Rs. 75 lakhs can opt for Composition scheme.

Composition dealers will pay nominal tax rates based on the type of business:

- Composition dealers are required to file only one quarterly return (instead of three monthly returns filed by normal taxpayers).

- They cannot issue taxable invoices, i.e., collect tax from customers and are required to pay the tax out of their own pocket.

- Businesses that have opted for Composition Scheme cannot claim any input tax credit.

Composition scheme is not applicable to :

- Service providers

- Inter-state sellers

- E-commerce sellers

- Supplier of non-taxable goods

- Manufacturer of Notified Goods

11. Benefits of registering under GST

11.A. For normal registered businesses:

1. Take input tax credit

2. Make interstate sales without restrictions

To know more about the benefits of GST click here.

11.B. For Composition dealers:

1. Limited compliance

2. Less tax liability

3. High working capital

To know more about composition scheme click here

11.C. For businesses that voluntarily opt-in for GST registration (Below Rs. 20 lakhs)

1. Take input tax credit

2. Make interstate sales without restrictions

3. Register on e-commerce websites

4. Have a competitive advantage compared to other businesses

To know more about voluntary registrations click here

GST-Updates

A. Changes in Composition Scheme

For turnover of more than Rs 1.5 cr:

- Composition scheme limit to be increased to Rs 1.5 crore (can be extended to Rs 2 crore later).

- 1 % GST rate for manufacturers & traders

- Composition tax of 1% on turnover of taxable goods (turnover of exempted goods to be excluded)

- Those supplying goods and services (services not exceeding Rs 5 lakhs in total) eligible for compositions scheme

- Composition Returns, GSTR-4 due date extended to 24th December

- Composition dealers cannot make inter-state sales. Input tax benefit not allowed.

B. Relief in GSTR compliance

- All businesses to file GSTR-1 and GSTR-3B till March 2018.

- GSTR-2 and GSTR-3 filing dates for July 2017 to March 2018 will be worked out later by a Committee of Officers

- Turnover under Rs 1.5 Cr to file quarterly GSTR-1

- Turnover above Rs 1.5 Cr to file monthly GSTR-1

- All businesses to file GSTR-3B by 20th of next month till March 2018.

C. Extension of GSTR-1 filing Due Dates

For turnover upto Rs. 1.5 cr:

| Period (Quarterly) | Due dates |

| July- Sept | 31st Dec 2017 |

| Oct- Dec | 15th Feb 2018 |

| Jan- Mar | 30th April 2018 |

For turnover of more than Rs 1.5 cr:

| Period | Dates |

| July to Oct | 31st Dec 2017 |

| Nov | 10th Jan 2018 |

| Dec | 10th Feb 2018 |

| Jan | 10th Mar 2018 |

| Feb | 10th Apr 2018 |

| March | 10th May 2018 |

D. Relief for service providers

All service providers with turnover up to Rs 20 lakhs exempt from GST registration. Including those who supply inter-state or supply through e-commerce operator, such service providers do not have to register.

E. Challenges ahead for Restaurants

GST rate cut to 5% with no input tax credit.

F. Other taxpayer relief measures

- Late Fees reduced – For delayed filing of NIL returns, late fee reduced from Rs 200 per day to Rs 20 per day.

- Late Fee credit – Late fees for GSTR-3B of July, Aug and Sept waived. Any late fees paid for these months will be credited back to Electronic Cash Ledger under ‘Tax’ and can be utilized to make GST payments.

- Manual filing of Advance Ruling application to be introduced

- Export of services to Nepal and Bhutan are exempt from GST and have now been allowed to claim a refund of input tax credit paid if any.

- TRAN-1 can be filed and revised until 31st December 2017. Revision to be done only once.

- Timelines for the filing of GSTR-2 and GSTR-3 for July to March 2018 to be worked out by Committee of Officers. However, subsequent month filing of GSTR-1 will not be impacted.

G. Others GSTR filing extensions

| Return | Revised Due Date | Old Due Date |

| GSTR-5 (for Non-Resident) | 15th Dec 2017 | Earlier of 20th August 2017 or 7 days from date of registration |

| GSTR-4 (for Composition Dealers) | 24th Dec 2017 | 18th October 2017 |

| GSTR-6 (for Input Service Distributor) | 31st Dec 2017 | 13th August 2017 |

| ITC-04 (for job work) for quarter of Jul-Sep | 31st Dec 2017 | 25th October 2017 |

| TRAN-1 | 31st Dec 2017 | 30th September 2017 |

H. GST Rate Changes

- 28% slab pruning cost to government= 20,000 crore

- 1 % composition rate for manufacturers & traders

- Reduced from 28% to 18% W.e.f. 15th Nov 2017 – Shampoo, Perfume, tiles, watches

- Reduced from 28% to 12% – Wet grinders, tanks

- Reduced from 18% to 12% – Condensed milk, refined sugar, diabetic food

- Reduced from 12% to 5% – Desiccated coconut, idli dosa batter, coir products

- Reduced from 5% to Nil – Duar meal, khandsari sugar, dried vegetables

- Restaurants within hotels (room tariff <7,500- 5% without ITC

- Restaurants within hotels (room tariff >7,500 ) still 18% with ITC

- Outdoor catering 18% with ITC

GSTR-1 Due Date Not Extended

- GSTR-1 Due Date Not Extended

There is no extension in the due date for GSTR-1 for July to Nov (monthly) and July to Sept (quarterly)

- 25th GST Council Meet to be held on 18th January 2018 – Expected discussion on rate changes and making GST compliance easy

Subscribe to:

Posts (Atom)

HSN Code List & GST Rate Finder

https://cleartax.in/s/gst-hsn-lookup

-

GST Registration Read here to know about the GST registration applicability on your business and the process thereof. Updated on Jan...

-

GSTR-1 Due Date Not Extended There is no extension in the due date for GSTR-1 for July to Nov (monthly) and July to Sept (quarterly) ...